Though I only made one post in 2025, this blog is not quite dead yet. Maybe it's just retired like me 😀. I officially retired at the end of November. I've been doing these annual reviews since 2011. They've mainly been an exercise for me to see what I accomplished and what I didn't in the previous year. The focus in 2025 was on the retirement process and my editorship of AJARE.

AJARE; In 2023, I took on the editor-in-chief role together with Yu Sheng and Johannes Sauer. I am the lead editor, and my role includes liaising with AARES as part of the AARES board and proof-reading articles before they are published. It turns out that the latter takes a lot of time to get right. Editing has begun to feel like almost a full time job as the number of articles we have published has gone up. The number of articles we sent to production in 2025 (to be published in 2025 or 2026) was double that in recent years. 2026 is going to be our last year as editors and from some point mid-year the new editorial team of Glyn Wittwer, Tom Kompas, and Deborah Peterson, will start handling new submissions. I was a member of the selection committee. We still have three issues of the journal to produce and five special sections/issues are in process. I will be happy when I won't have to do this any more, though I think it was a worthwhile experience. It's a bit like how I feel about teaching. A little is good, but a lot is hard work.

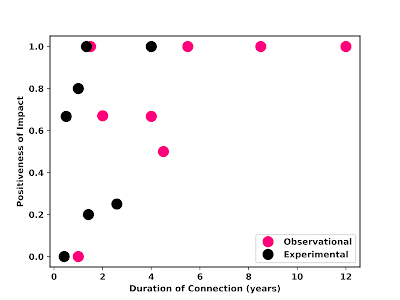

Conferences and Travel: The AARES Conference was in Brisbane this year, and so I travelled to attend it. We held another "Meet the Editors" session and I presented a paper on "Econometric Modelling of the Impact of Climate Change on Economic Growth." More on that below. In August, I travelled to Sydney to take part in the 2nd Economic Impacts of Climate Change Workshop at UNSW presenting on "How Effective is Carbon Pricing in Reducing Carbon Emissions Intensity? A Meta-Analysis of the Quasi-Experimental Research." I was back in Sydney in September to present at UTS on the same topic.

In December, I travelled with my family to Vietnam and China. We travelled on Vietnam Airways. The first leg was a direct flight from Sydney to Hanoi. Hanoi is very busy and noisy and air pollution was very high most of the days we were there. We went on a daytrip to Lan Ha Bay and Cat Ba Island, which was my favourite part of the whole trip. The weather there was perfect.

Cycling on Cat Ba Island

We then flew to Beijing and visited my mother-in-law in Tianjin. We did a side trip to Hangzhou to meet with one of my wife's friends who splits her time between there and New Jersey now. She is also originally from Tianjin. This was the best part of the China trip.

Leifeng Pagoda and West Lake, Hangzhou

Finally, we returned to Vietnam, to Danang. This was much more relaxed than Hanoi. We rented a house and my brother flew out from Israel to meet up with us there.

My Son, near Danang

Teaching: I ended up only teaching one course – IDEC8053 Environmental Economics – in Semester 2. I dropped live lectures, or at least I tried to. I recorded videos of short lecture segments and told the students to watch those before coming to the "workshop". Rarely did anyone actually watch the videos. So, I improvised, giving a mini-lecture on the key points needed to do the "tutorial" problems. Then we did the problems. This kind of worked. Also, I dropped the essay assignment because of AI. Instead, I got students to prepare a presentation. We did the presentations on Zoom. I did 6-8 of these a day until they were all done. It took less time to do these than it would have taken for me to read and grade essays and it was much more fun. Most of the grade was for how well they answered questions.

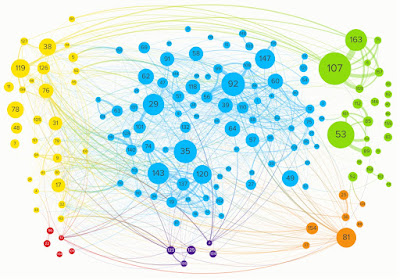

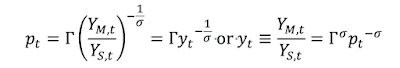

Research and Publications: It was again a slow year for research. I gave up working on the paper on the economic impact of climate change, which I presented at AARES. Results were very sensitive to small specification changes and I don't understand why. I continued working with my PhD students MiLim Kim and Banna Banik and a group of researchers in Germany including Stephan Bruns and Jan Minx on meta-analysis of the impact of carbon-pricing policies. MiLim submitted her PhD this month and I will be editing her chapter on the topic into a potential journal article soon. Banna's work is at an early stage still.

I published no journal articles or working papers. I did publish some book chapters. One on the rebound effect, one on China's carbon emissions after the pandemic, and there is another one in press on the environmental Kuznets curve.

We resubmitted our paper on recursive impact factors yet again. At the end of the year, we got a revise and resubmit for our paper on electrification impacts in India.

Google Scholar citations reached roughly 29,750 with an h-index of 67.

Outreach and Service: As mentioned above, I did almost no blogging. Twitter followers are slightly down! I reviewed 6 journal articles, two tenure/promotion cases, and one grant proposal. I examined two PhD theses. I am taking on far fewer reviews than I used to because of my role as AJARE editor.

Retiring: ANU announced a restructuring program in 2024. In early 2025 a voluntary redundancy program (VSS) was announced. I submitted an application. But then shortly after the deadline, Trump announced his Liberation Day tariffs and financial markets fell. I felt much less certain about living off investments instead of a regular salary. I wasn't sleeping much. I decided to withdraw my application even though my case was approved. In the process, my other course was given away, but I agreed to prepare a new course for 2026 - Economics for Government. Later in the year the university reopened the VSS. All previous applications were reconsidered and I was approved again. This time, I didn't change my mind. Based on the numbers, I thought I could afford to retire. I have been disillusioned with teaching (not that I was ever that excited about it). I thought about going half time and only teaching one course a year. But I would need to work half time for four years to match the money I was paid by the VSS. So, I took the leap. As mentioned above, I am still editor of AJARE for now and have one PhD student I am primary supervisor for. I plan to remain involved with research. Maybe I will even do a bit more. This week, I moved to a smaller office in Old Canberra House and will travel to Adelaide for the AARES Conference next week. Let's see what happens.