I have a new working paper coauthored with my master's student Suryadeepto Nag on the impact of rural electrification in India. Surya did his master's at IISER in Pune with me as his supervisor. He visited Canberra over the last Southern Summer. This paper is based on part of Surya's thesis.

The effect of providing households with access to electricity has been a popular research topic. It's still not clear how large the benefits of such interventions are. Is electricity access an investment that generates growth? Or is it more of a consumption good that growing economies can afford? Researchers have used traditional econometric methods on secondary data (observational studies) and also carried out field experiments, such as randomized controlled trials (RCTs), to try to answer this question.

Experimental methods have generally found smaller and less statistically significant results than observational studies have. Is this because experiments are more rigorous? Or because observational studies usually measure impacts over a longer period of time? It's likely that it takes time for people to make use of a new electricity connection. They will need to save and buy appliances. Effects on children's education will take an especially long time to come to fruition.

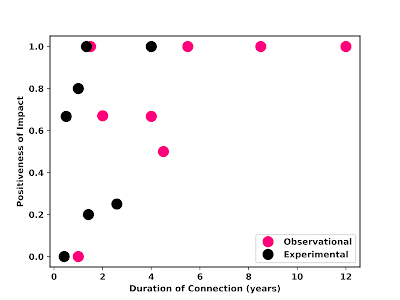

We carry out a meta-analysis of 16 studies previously reviewed by Bayer et al. (2020):

We assigned each positive impact (for example on income or on education) found in a study the score of 1 and each negative impact a -1 and then averaged over all the impacts. The graph shows this "positiveness of impact" compared to the time households had been connected to electricity. While observational studies found more positive impacts than experimental studies, there is also a positive correlation between duration of connection and positiveness of impact (and between duration of connection and being an observational study). Regression analysis shows that only duration of connection is statistically significant.

But this small sample of studies can't be that conclusive, so we then carry out our own analysis to test whether impacts increase over time.

Using three waves of Indian household surveys from 1994-95, 2004-5, and 2011-12, we quantify the impacts of short-term (0-7 years) and long-term (7-17 years) electricity access on rural household well-being. These surveys tracked the same households over time. We don't know exactly when a household was connected, just whether it was already connected in 1994-95 or whether it got connected between the other surveys. We do know when villages were connected.

We use a difference in differences regression that is weighted using "inverse propensity scores". This is supposed to compensate for the fact that households are not actually connected randomly to the grid. If, for example, poor households are less likely to get connected, we overweight them in the sample. In our main analysis, we exclude households that were already connected in 1994-95 so that the control group only includes households that were not connected by 2011-12.*

We find that long-term electricity access increases per capita consumption and education, and reduces the time spent by women on fuel collection (compared to the control group). The effect of short-term connection is smaller and statistically insignificant. We find no significant effects on agricultural income, agricultural land holding, and kerosene consumption.

Here is our main table of results:

The long-term impact on consumption is really very big – 18 percentage points more than the control group over a 7 year period. The effect on education is 0.4 of a year relative to the control group.

We did some robustness tests – using different weights and including the households connected before 1994-95 as "very long-term connections". The results roughly hold up, though the weighting isn't ideal in either case.

We think our results show that experimental studies really need longer term follow-ups before coming to conclusions.

* The recent research on differences in differences shows that many past studies used inappropriate control groups.