We have finally posted our long-promised paper on the Industrial Revolution as a CAMA Working Paper. This is the final paper from our ARC-funded DP12 project: "Energy Transitions: Past, Present and Future". The paper is coauthored with Jack Pezzey and Yingying Lu. We wrote our ARC proposal in 2011, but we "only" started work on the current model in late 2014 after I read Acemoglu's paper "Directed Technical Change" in detail on a flight back to Australia and figured out how to apply it to our case. We have presented the paper many times in seminars and conferences, though I will be presenting it again at the University of Sydney on April 6th.

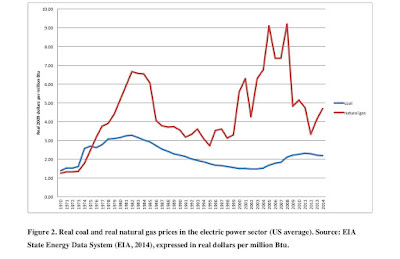

The paper develops a directed technical change model of economic growth where there are two sectors of the economy each using a specific type of energy as well as machines and labor. The Malthus sector uses wood, which is only available in a fixed quantity per year, and the Solow sector uses coal, which is available at a fixed price. These assumptions are supported by the data. We don't think it is necessary to model coal as an explicitly non-renewable resource. As shallow deposits were worked out, technological change, including the development of the steam engine, allowed the exploitation of deeper deposits at more or less constant cost.

The names of the sectors come from the paper by Hansen and Prescott (2002): Malthus to Solow. That paper assumes that technological change is exogenous and happens at a faster fixed rate in the Solow sector (which only uses labor and capital) than in the Malthus sector (which also uses a fixed quantity of land). The Solow sector is initially backward but because technical change is more rapid in that sector and it is not held back by fixed land, eventually it comes to dominate the economy in an industrial revolution.

Our paper updates this model for the 21st Century. In our model, technological change is endogenous, as is the speed with which it happens in each sector - the direction of technical change. We don't assume, a priori, that it is easier to find new ideas in the coal-using sector. In fact, we don't assume any differences between the sectors apart from the supply conditions of the two energy sources, which we explicitly model.

In most cases, an industrial revolution eventually happens. The most interesting case is when the elasticity of substitution between the outputs of the Malthus and Solow sector's is sufficiently high - based on our best guesses of the model parameters in Britain, greater than 2.9 - then it is possible if wood is relatively abundant for an economy to remain trapped forever in what we call Malthusian Sluggishness where growth is very low.* Population growth can push an economy out of this zone by raising the price of wood relative to coal and send the economy on a path to an industrial revolution.

These two phase diagrams show the two alternative paths an economy can take in the absence of population growth, depending on its initial endowment of knowledge and resources:

N is the ratio of knowledge in the Malthus sector (actually varieties of machines) to knowledge in the Solow sector. y is the ratio of output in the two sectors and e is the ratio of the price of wood to the price of coal. In the first diagram we see that an economy on an industrial revolution path first has rising wood prices relative to coal and also, initially, technical change is more rapid in the Malthus sector than in the Solow sector and so N rises too. In the long-run both these trends reverse and under Modern Economic Growth technical change is more rapid in the Solow sector and the relative price of wood falls. At the same time, we see in the second diagram that eventually the output of the Solow sector grows more rapidly than that of the Malthus sector so that y falls. The rate of economic growth also accelerates.

But an economy which starts out with a low relative wood price, e, or low relative knowledge in the Solow sector, N, can remain trapped with rising wood prices AND increasing specialization in the Malthus sector - rising y and N. Though there is coal lying underground, it is never exploited, even though switching to coal use would unleash more rapid economic growth in the long run. The myopic, but realistic, focus on near term profits from innovation discourages the required innovation in the Solow sector.

The core of the paper is a set of formal propositions laying out the logic of these findings but we also carry out simulations of the model calibrated to the British case over the period 1560-1900. Counterfactual simulations with more abundant wood, more expensive coal, more substitutability, less initial knowledge about using coal, or less population growth all delay the coming of the Industrial Revolution.

* We assume either that population is constant or treat its growth as exogenous.

The paper develops a directed technical change model of economic growth where there are two sectors of the economy each using a specific type of energy as well as machines and labor. The Malthus sector uses wood, which is only available in a fixed quantity per year, and the Solow sector uses coal, which is available at a fixed price. These assumptions are supported by the data. We don't think it is necessary to model coal as an explicitly non-renewable resource. As shallow deposits were worked out, technological change, including the development of the steam engine, allowed the exploitation of deeper deposits at more or less constant cost.

The names of the sectors come from the paper by Hansen and Prescott (2002): Malthus to Solow. That paper assumes that technological change is exogenous and happens at a faster fixed rate in the Solow sector (which only uses labor and capital) than in the Malthus sector (which also uses a fixed quantity of land). The Solow sector is initially backward but because technical change is more rapid in that sector and it is not held back by fixed land, eventually it comes to dominate the economy in an industrial revolution.

Our paper updates this model for the 21st Century. In our model, technological change is endogenous, as is the speed with which it happens in each sector - the direction of technical change. We don't assume, a priori, that it is easier to find new ideas in the coal-using sector. In fact, we don't assume any differences between the sectors apart from the supply conditions of the two energy sources, which we explicitly model.

In most cases, an industrial revolution eventually happens. The most interesting case is when the elasticity of substitution between the outputs of the Malthus and Solow sector's is sufficiently high - based on our best guesses of the model parameters in Britain, greater than 2.9 - then it is possible if wood is relatively abundant for an economy to remain trapped forever in what we call Malthusian Sluggishness where growth is very low.* Population growth can push an economy out of this zone by raising the price of wood relative to coal and send the economy on a path to an industrial revolution.

These two phase diagrams show the two alternative paths an economy can take in the absence of population growth, depending on its initial endowment of knowledge and resources:

N is the ratio of knowledge in the Malthus sector (actually varieties of machines) to knowledge in the Solow sector. y is the ratio of output in the two sectors and e is the ratio of the price of wood to the price of coal. In the first diagram we see that an economy on an industrial revolution path first has rising wood prices relative to coal and also, initially, technical change is more rapid in the Malthus sector than in the Solow sector and so N rises too. In the long-run both these trends reverse and under Modern Economic Growth technical change is more rapid in the Solow sector and the relative price of wood falls. At the same time, we see in the second diagram that eventually the output of the Solow sector grows more rapidly than that of the Malthus sector so that y falls. The rate of economic growth also accelerates.

But an economy which starts out with a low relative wood price, e, or low relative knowledge in the Solow sector, N, can remain trapped with rising wood prices AND increasing specialization in the Malthus sector - rising y and N. Though there is coal lying underground, it is never exploited, even though switching to coal use would unleash more rapid economic growth in the long run. The myopic, but realistic, focus on near term profits from innovation discourages the required innovation in the Solow sector.

The core of the paper is a set of formal propositions laying out the logic of these findings but we also carry out simulations of the model calibrated to the British case over the period 1560-1900. Counterfactual simulations with more abundant wood, more expensive coal, more substitutability, less initial knowledge about using coal, or less population growth all delay the coming of the Industrial Revolution.

* We assume either that population is constant or treat its growth as exogenous.