Most of my readers are probably familiar with the correlation between corruption and the level of economic development, but as I was entering the data into my database I thought I'd go ahead and blog about it. The chart shows the 2007 Transparency International Corruption Perception Index on the Y axis and average income per capita over the 1971-2007 period in 2007 PPP dollars (from the Penn World Table) on the X axis for the 85 countries in my energy efficiency study. The sample excludes oil economies. The correlation between these variables in the sample is 0.90. It goes to 0.92 when Luxembourg - the point at the extreme right - is excluded. Including the petroleum exporters would reduce the correlation. The corruption index is bounded from above at 10.

The direction of causation is not clearcut. Poor countries tend to underpay their government employees (relative to the private sector) resulting in these employees seeking (small) bribes to make ends meet. In the other direction, corruption (large bribes) is supposed to result in economic policies that protect special interests and according to the

Prescott-Parente theory of growth reduce total factor productivity and, therefore, GDP per capita in corrupt countries. My perception is that special interests in the energy and mining industries do wield a lot of influence in nominally low corruption economies such as the US and Australia.

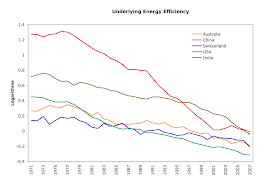

My colleague, Sambit Bhattacharya's research shows that resource endowments do not negatively affect growth in democracies. But do they negatively affect energy efficiency and environmental quality? In my Hub research, I am going to test the effects of resource endowments, perceived corruption and other variables on energy efficiency and hopefully come up with some answers.